Stories

Awareness Builds for EDGE in India

EDGE is gaining traction in the Indian market because of its software application, streamlined certification process, and overall brand value.

In a candid chat with The Construction Times of India, Rebecca Menes, the Global Marketing Lead for EDGE, shares her thoughts on how governments, banks, builders and homebuyers are aligning around the concept of green buildings. A start-up created by the International Finance Corporation (IFC), a part of the World Bank Group, EDGE is gaining traction in the Indian market because of its software application, streamlined certification process, and overall brand value. EDGE is funded by SECO with additional support provided by the EU.

What is EDGE all about? What segments are you present in? What’s your business model like?

EDGE focuses on the business case for building green and the value proposition to property developers to certify their projects as efficient in energy, water and embodied energy in materials. An innovation of IFC, EDGE is available in 144 countries, including India. EDGE can be used to certify residential and commercial buildings, either new or refurbished. Our aim is to create a paradigm shift where builders, banks, governments and homebuyers are all winning financially by building green, so that together we can mainstream resource-efficient buildings.

What kind of innovations are you doing in India to have an edge over the other players, in the same space?

Property developers who choose to certify their buildings with EDGE benefit from the position of being first-movers in the market, to differentiate their buildings and attract and retain more customers. EDGE certification is streamlined and affordable, offering a certification process that is conducted entirely online. The software application is unique in the world, enabling decision-making as to the most cost-effective ways to build green in a bioclimatic way. This is particularly important in a vast country such as India where the climate varies greatly.

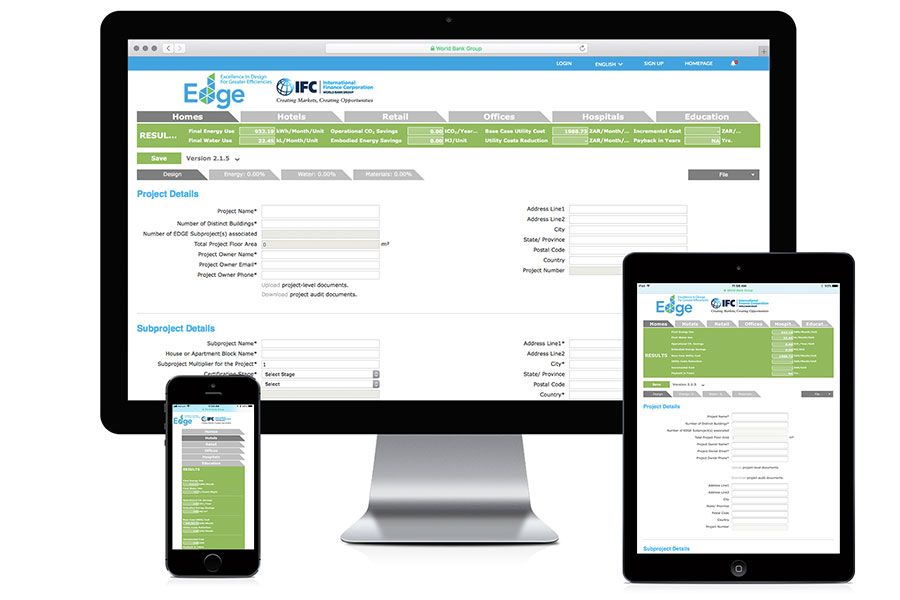

The EDGE software application, which is available for free for all those who wish to design resource-efficient buildings.

In addition to association with the trusted World Bank Group brand, EDGE also offers the technical strength and integrity of GBCI, our exclusive certification provider in India. Technical rigor will become increasingly important as incentives come onto the market from financial institutions whose decisions are influenced by risk. GBCI, which also offers LEED certification, shares IFC’s ambition to scale up green buildings in emerging markets such as India.

What other observations do you have regarding the Indian market?

In comparison to other markets where EDGE operates, the property sector in India is both incredibly sophisticated and ambitious. Developers are certifying their entire portfolios green, which is an example for other countries to follow. There is the deep understanding in India that conventional buildings will soon become stranded assets unless they are certified with either EDGE, IGBC, GRIHA or LEED. What is refreshing to see is major companies such as Mahindra are extending this philosophy to their affordable housing line, which will greatly benefit low-income families through reduced utility bills.

The EDGE-certified Vaibhava Bangalore by Value Budget Housing Corporation.

Is EDGE part of the incentive programs that state-level governments are offering to encourage green buildings?

Yes. Because EDGE is a newcomer we are just starting to be included in government incentive programs such as in Pune, which allows additional FSI at 3%, 5% and 7% for properties that achieve 30%, 40% and 50% resource efficiency (respectively) as verified through EDGE certification. Recently in Karnataka it was announced that the government is considering incentives for all major certification systems operating in India – and more government incentives are on the near horizon, that plan to include EDGE. It’s fantastic to see how state-level governments are helping to shape the future of how buildings are being built in India. Once financial incentives come on the market, there will no longer be a business case for conventional buildings.

The Rainbow Children’s Hospital outside Bengaluru committed to EDGE certification, as can be seen in this video .

What kind of expansion plans do you have in India?

Where IFC can really leverage its influence is in the financial sector. There is plenty of liquidity available for green construction financing and green mortgages, but the effectiveness of linking low-risk investment to certified green buildings where homeowners have fewer late payments and lower default rates is still largely unproven in India. IFC predicts there is a $1.4 trillion investment opportunity in green buildings in India (between 2018 and 2030) according to its report, Climate Investment Opportunities in South Asia. As a confirmation of its own belief, IFC invested a record-high of $2.6 billion in India in fiscal year 2018, which includes investments in HDFC and Mahindra & Mahindra.

The green bond industry, which is expected to reach $210 billion globally by the end of 2018, is also intent on building investor confidence through a metrics-driven approach to green buildings. Once we have evidence in hand, an abundance of government and banking incentives, and growth in consumer demand, then we know for certain that the next generation of buildings will be built green. With the support of GBCI and our early adopters in India, EDGE can help to make this happen.

For certification inquiries, visit EDGE in India or contact Rohith Ravula at edge@gbci.org.

This article originally appeared in the December 2018 green issue of The Construction Times of India.