Stories

From Romania to Costa Rica – The Persuasive Power of Green Mortgages

There are heroes working behind the scenes to create a new mortgage breed that upends the industry, making it a given to choose a green home.

Steven Borncamp, adviser to the Romania Green Building Council and the driving force behind a green mortgage program in Romania.

There are two homes across the street from each other and both are for sale. They look the same, except one costs more than the other. As a buyer, which would you choose? Obviously, you would choose the less expensive one.

Now look more closely. The more expensive home has outdoor shading on the windows, and a solar hot water collector on top. The real estate agent says the home has thermal insulation, energy-efficient lighting, and hardware to conserve water, and is certified green. Now which would you buy?

Perform a few calculations and you’ll figure out that the pricier home is to your advantage, because the extra cost of the mortgage is more than compensated for by lower utility bills. This is particularly true in a cold country like Romania and a hot country like Costa Rica.

There are heroes working behind the scenes in these exact two countries to create a new mortgage breed that upends the industry, making it a given to choose a green home. While the models differ, they both result in a triple win where the developer offers a better product, the bank takes on less risk, and the buyer keeps more earned income.

Less Risk in Romania

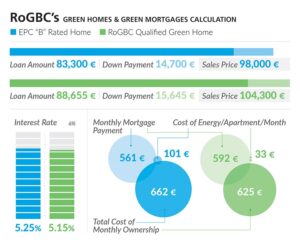

The Romania Green Building Council (RoGBC) has made critical progress in shifting homebuyers’ thinking towards green mortgages. Because green homes cost slightly more, buyers can take on a larger loan but make a lower payment, due to a combination of utility savings and a better mortgage rate. In other words, the more attractive monthly outlay wins against the immediacy of a lower sales price.

RoGBC’s model assumes a 70 square-meter home with 15 percent down and a payment period of 20 years. Borrowers in both scenarios are of equal credit worthiness determined through typical underwriting procedures. The “B” rated home is determined by an Energy Performance Certificate (EPC) score. The RoGBC Qualified Green Home must pass an RoGBC audit of additional, stringent green criteria. Calculations are meant to be indicative and the interest rate may or may not be the same as participating banks in RoGBC’s program.

Here’s how they made it happen. Steven Borncamp, an adviser to the RoGBC who recognized the failure of homebuyers to consider “total cost of ownership.” He discovered the national regulatory authority allows green homebuyers to count estimated energy savings as an additional source of income in loan applications. It was a critical factor in the development of RoGBC’s “Green Homes and Green Mortgages” program.

Raiffeisen Romania (an affiliate of the Austrian banking group) is the first to participate in the program, which is open to all banks who offer a lower mortgage rate to qualified applicants. A homebuyer finances the developer’s extra costs to build and certify green through an elevated sales price – without increasing their monthly home ownership costs.

Developers now have more wiggle room to invest in a superior product that is tied to a better mortgage rate, providing the critical stimulus needed to redirect the construction industry towards higher performing buildings. While homes must meet RoGBC’s stringent requirements for energy and other green criteria, certification costs are kept low by utilizing the energy audit work required in Romania. RoGBC also accepts projects that score significantly in other internationally-recognized certification systems, such as EDGE, LEED, and BREEAM.

RoGBC’s Executive Director, Dr. Monica Ardeleanu, convinced 19 residential developers to enroll more than 6,000 units in the program, which equals about 12 percent of the units typically delivered in one year in Romania. “In addition to overall market share, the most reputable developers have signed on to our program, which ensures others will follow,” says Ardeleanu. The projects are estimated to reduce energy costs by up to 60 percent.

Borncamp says that participating banks will not only experience greater profitability due to lower risk, they will also benefit reputationally by upholding a higher performance standard for their lending. Green mortgages create greater trust between banks and buyers, who often underinvest in construction due to a fear of taking on debt.

“The wisdom of borrowing sensibly to build correctly pays for itself even without a reduced interest rate for green homes,” says Borncamp. “That green homes can generate annual energy savings in excess of a monthly mortgage payment has positive implications for reducing risk. This will be a game-changer when more banks start adopting it.”

Michelle Espinach, the Sustainable Bank Manager for Promerica, who has helped move the Costa Rican bank’s mortgage product from conventional to green.

Multilateral Support in Costa Rica

On the other side of the world, Banco Promerica has middle-class mortgages down to a science. The bank decides the property’s location, focuses on first-time buyers (who are less risky than those with a second home at the beach), ensures the loan to value doesn’t dip below 85-90 percent, and sets a payment/income ratio of 55 percent. With this tight control, the bank’s past due rate is three percent and its default rate is less than one home per year. With such a successful conventional loan offering, why would Promerica be interested in exploring a green mortgage concept?

This is where Michelle Espinach, Promerica’s Sustainable Bank Manager, steps in. Espinach has succeeded in offering homeowners favorable conditions for green mortgages through a partnership with FMO, the Dutch development bank. Since mortgages in Costa Rica are mainly given by public banks, Banco Promerica must be faster, offer better terms, and provide better service, in order to grow its small share of the market and expand its mortgage portfolio (currently 10 percent of its business).

“We have an opportunity to do something really big,” says Espinach. “Our first projects, which will be certified with IFC’s EDGE by the Green Building Council Costa Rica, will be deep green. Once these projects come onto the market in 2019, they will influence other developers.”

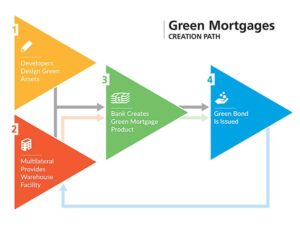

Property developers must provide enough green homes to reach a critical threshold where a bank can then create a green mortgage product. A warehouse facility from a multilateral development agency with a special financing rate may be needed. The bank then issues a green bond into the local market, which generates future income for the financing of even more green mortgages.

Costa Rica has a tricky economy because of the mix of U.S. dollars and local currency. Mortgages are typically fixed rate for only two years. While salaries are paid in colones, buyers prefer a mortgage in dollars, which is a more stable currency. Banco Promerica accessed funding from a warehouse facility provided by FMO that enables the bank to offer mortgages with attractive rates in U.S. dollars – a coveted offering for a private bank in Costa Rica. In turn, FMO fulfills its mission to make a difference in people’s lives and help mitigate climate change.

While the cost of certification will be passed from developer to buyer, Espinach doesn’t believe buyers in Costa Rica are willing to absorb the developer’s extra capital costs for going green. The developer needs “some kind of candy,” says Espinach, as in a better construction financing rate. This puts her back at the multilateral doorstep to develop another financial product to help reduce these costs.

With the progress she’s already made, it’s hard to imagine Espinach not succeeding. “Hopefully, our projects will change the way construction is approached in Costa Rica,” she declares. “Everyone will want to build green.”

“From Romania to Costa Rica: The Persuasive Power of Green Mortgages” originally appeared in The Triple Pundit and has been published with permission.